Past due

The past due section contains payments that have gone into a past due or failed status. You can easily see a total of these past due payments and take action to ensure these payments are made.

Table of Contents

Permissions and accessibility

Staff access:

- Admin

- Full access

- Manager

- Full access

- Staff

- No access

MyStudio plan restrictions:

- None

Past due payments

Payments can enter past due status for various reasons, including:

- Failed credit card payment

- Failed ACH payment

- The payment is supposed to be paid by cash or check by the customer and it is past the due date

- Failed SCA verifications

When a payment goes into a past due status, the customer will receive an email. If there was a credit card or ACH attached to the payment, the email will prompt them to update their payment method on file. If the customer updates the payment method, their past due payment will rerun automatically. If a manual payment method such as cash or check was attached to the payment, the email will not contain an “update” option.

Customers will receive this past due payment email every 3 days until credit is applied to the past due payment or the customer updates the payment method. Additionally, customers will not be able to access the member app if they have past due payments on file connected with a credit card or ACH. Customers will be prompted to update the payment method on file for these payments or rerun the payments as soon as they login and attempt to go to a category within the app.

Any past due payment attached to a credit card or ACH can be rerun either from the payments > payment history section, or from within a registration page’s payment history.

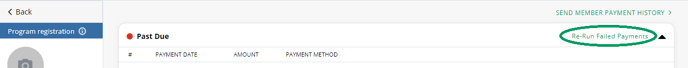

Payment history:

Registration page:

When a customer is paying for a past due amount that is attached to a manual payment type, you will have to apply the cash or check amount to the payment by clicking on the buyer name > drop down the “past due” tab > click on the past due payment > apply credit.

You will then enter the amount they are applying towards the past due payment and select what kind of payment method is being applied. If a customer is paying for more than one past due amount, these have to be applied separately.

Manual credits

You can also choose to waive a past due payment by applying a manual credit. Manual credits are compensation given by the business to the customer, similar to a coupon, and does not count towards income statistics. To apply a manual credit, you will click on the buyer name in the past due list > drop down the “past due” tab > click on the past due payment > apply credit.

You will then enter the amount they are crediting to the customer and select “manual credit” as the credit method.

Once a manual credit has been applied, the payment total will be displayed under the manual credit category in both the analytics and payment history sections.

Past due table

Filters

At the top of the section, you will see the following filter options:

- Category

- All categories: shows all types of past due payments in the table

- Memberships: shows only membership past due payments in the table

- Events: shows only past due event payments in the table

- Trials: shows only past due trial payments in the table

- Retail: shows only past due retail payments in the table

- Miscellaneous: shows only past due custom charges in the table

- Class / Appt: shows only past due class/appt payments based on drop-in pricing

- Date range

- Last 30/60/90 days: shows only past due payments that occurred in the last 30/60/90 days

- Date range: unlocks the “Start Date” and “End Date” fields so users can choose a specific date or date range. This is helpful for those who want to see all past due payments from a particular day.

- All: shows all past due payments

- Month-to-date: shows past due payments that occurred from the first of the current month to the current date. For example, if today is February 22, the table will show transactions that occurred from February 1 - February 22.

Statistics and data

Above the table, you will see a gross total for the past due payments as it pertains to the date range selected. This gross total includes admin and processing fees and tax.

You can select specific or all past due payments from the table and do one of the following:

- Export: export the info of the selected payments into a CSV file.

- Rerun payment: the system will rerun credit card or ACH payments that may have failed due to insufficient funds, general decline, etc.

You can also search for specific transactions, buyers, payment types, etc. in the search bar.

The table displays various information about each transaction. Some columns worth noting are:

- Due date: shows the date the payment was due.

- Buyer: clicking on the buyer name will redirect you to the payment history within the specific registration internal page. You will have to then click the “Past Due” drop down tab in order to see the past due payment.

- Mobile phone number: if a customer has unsubscribed from SMS and the phone number is listed as such, you can click on this phone number to send a request for the customer to re-subscribe to SMS.

- Email: clicking on the email will allow you to send an email to the specified customer. If the email is unsubscribed, you can click the email to send a request for the customer to re-subscribe to email. If the email has bounced, you can click the email to unblock the email.

- Gross: shows the full payment amount. Gross total = Product Fee + tax + admin and processing fees.

- Status:

- Past: payment has gone into a past due status. This generally occurs for manual payments gone into past due status or for most credit card declines.

- Failed: payment failed. This generally occurs for failed SCA verifications or there was an error during the system communicating the payment to the customer’s bank.

- Payment type:

- Scheduled billing: billing that occurs after a registration occurs. Example: a customer registers for a membership that has monthly payments. This includes if the first payment is taken at a future membership start date.

- New: new transactions or payments that occurred at registration. Example: a retail order, or a customer registers for a membership and makes a payment during registration.

Failed payments

What are failed payments?

Failed payments occur when there is an issue with the payment method on file for a registration. This can be an immediate notice, such as during a registration, or it can become a failed payment later.

If a payment fails, it will display in your MyStudio account in payments > past due. Depending on the reason for the failure, it may have a status of either "failed" or "past due."

Why did the payment fail?

For accounts connected to Stripe, you can check why a payment failed by going to payments > past due payments and export the transaction(s) you wish to check. This exported table will have a column for the payment error description, listing the reason for the failure.

Note: transactions made before August 14, 2024 will not show a payment error description. We recommend re-running these payments first, and if it fails again the error description will appear for the rerun.

Check out the table below for reasons payments could fail and the actions you can take. If you have any further questions about these reasons, please reach out to our customer care team via phone 757-997-1233 or live chat at the bottom right corner of your control panel.

| Listed reason | Next steps |

| The card was declined because the transaction requires authentication such as 3D Secure. | Try re-running the payment to allow the customer to authenticate the transaction. If the card issuer returns this decline code despite a successfully authenticated transaction, the customer needs to contact their card issuer for more information. |

| The payment can't be authorized. | Attempt the payment again. If you still can’t process it, the customer needs to contact their card issuer. |

| The card was declined for an unknown reason. | The customer needs to contact their card issuer for more information. |

| The card does not support this type of purchase. | The customer needs to contact their card issuer to make sure their card can be used to make this type of purchase. |

| The customer has exceeded the balance, credit limit, or transaction amount limit available on their card. | The customer needs to contact their card issuer for more information. |

| The card does not support the specified currency. | The customer needs to check with the issuer whether the card can be used for the type of currency specified. A different payment method may need to be used. |

| A transaction with identical amount and credit card information was submitted very recently. | Check to see if a recent payment already exists. |

| The card has expired. | The customer needs to use another card. |

| The card was declined for an unknown reason or Stripe Radar blocked the payment. | The customer needs to contact their card issuer for more information. |

| The card number is incorrect. | The customer needs to try again using the correct card number. |

| The CVC number is incorrect. | The customer needs to try again using the correct CVC. |

| The PIN entered is incorrect. This decline code only applies to payments made with a card reader. | The customer needs to try again using the correct PIN. |

| The postal code is incorrect. | The customer needs to try again using the correct billing postal code. |

| The card has insufficient funds to complete the purchase. | The customer needs to use an alternative payment method. |

| The card, or account the card is connected to, is invalid. | The customer needs to contact their card issuer to check that the card is working correctly. |

| The payment amount is invalid, or exceeds the amount that’s allowed. | If the amount appears to be correct, the customer needs to check with their card issuer that they can make purchases of that amount. |

| The expiration month is invalid. | The customer needs to try again using the correct expiration date. |

| The expiration year is invalid. | The customer needs try again using the correct expiration date. |

| The card issuer couldn’t be reached, so the payment couldn’t be authorized. | Attempt the payment again. If you still can’t process it, the customer needs to contact their card issuer. |

| The payment isn’t permitted. | The customer needs to contact their card issuer for more information. |

| The card was declined because it requires a PIN. | The customer needs to try again by inserting their card and entering a PIN. |

| The customer can’t use this card to make this payment (it’s possible it was reported lost or stolen). | They need to contact their card issuer for more information. |

| The allowable number of PIN tries was exceeded. | The customer must use another card or method of payment. |

| An error occurred while processing the card. | The payment needs to be attempted again. If it still can’t be processed, try again later. |

| The payment couldn’t be processed by the issuer for an unknown reason. | The payment needs to be attempted again. If it still can’t be processed, the customer needs to contact their card issuer. |

| A Stripe test card number was used. | A genuine card must be used to make a payment. |

| The customer has exceeded the balance or credit limit available on their card. | The customer needs to use an alternative payment method. |

The following additional reason descriptions need to be handled more carefully:

| Listed reason | Next steps |

| The payment was declined because Stripe suspects that it’s fraudulent. | Don’t report more detailed information to your customer. Instead, present it as "the customer needs to contact their card issuer for more information." |

| The payment was declined because the card is reported lost. | |

| The payment was declined because it matches a value on the Stripe user’s block list. | |

| The payment was declined because the card is reported stolen. |

Note: if your exported payment history lists a transaction as past due and does not contain a payment method or payment error description, this means the customer pays manually with cash or check, and payment needs to be taken in person.

General solutions

1. Rerun

Any failed payment attached to a credit card or ACH can be rerun either from the payments > payment history section, or from within a registration page’s payment history. We recommend doing this first.

Payment history: go to payments > payment history > check the box next to the payment > click "rerun payment."

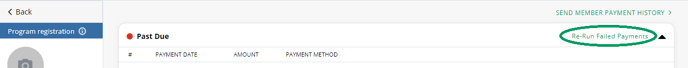

Registration page: go to all customers > participants > the category the past due payment is in (in the screenshot below I went to program participants) > click the participant name > payments > click "re-run failed payments."

Clicking this re-run failed payments option will re-run ALL listed failed payments. If you want to only re-run individual ones, drop down the list > click the past due payment you would like to re-run > re-run payment.

2: Customer notification

If re-running the payment method still results in a failed payment, export the failed payment and check the reasoning column. There may be an issue with the customer's card that they need to address with their bank. Even in cases where the reason listed is unknown, it is still good to inform the customer.

When a payment goes into a past due status, the customer will receive an email. If there was a credit card or ACH attached to the payment, the email will prompt them to update their payment method on file. If the customer updates the payment method, their past due payment will rerun automatically. If a manual payment method such as cash or check was attached to the payment, the email will not contain an “update” option.

Customers will receive this past due payment email every 3 days until credit is applied to the past due payment or the customer updates the payment method. Additionally, customers will not be able to access the member app if they have past due payments on file connected with a credit card or ACH. Customers will be prompted to update the payment method on file for these payments or rerun the payments as soon as they login and attempt to go to a category within the app.

3. Update payment method

If rerunning the payment doesn't work and the customer doesn't automatically update the payment info from the email, you will need to ask the customer to update their payment information for the registration. To do this, go to all customers > participants > the category the past due payment is in > click the participant name. In the example below we are in a program registration internal page.

Under payment method, click "send link for user to update payment method." This will send them an email prompting them to update their payment information. Once they do, ALL failed payments under that registration will be re-run at once.