MyStudio Stripe Account Setup

Setting up your MyStudio Stripe account is a simple, seven-step process. This guide provides instructions and answers to common questions, ensuring a smooth setup and proper tax reporting.

Updated: November 21, 2025

Table of contents

How to set up MyStudio Stripe account

Step 1: Verify who can set up Stripe account

During account set up, Stripe will request information for the business representative. This must be the official owner of the business–not a location manager, staff member, or program director.

The Business Representative is the individual who:

-

Owns or controls the business

-

Is legally responsible for tax and financial reporting

-

Will be listed by the IRS when issuing a 1099-K form.

Important: Entering incorrect or non-owner information may result in delays, incorrect tax forms, or compliance issues.

Step 2: Click the banner at the top of the MyStudio platform

This will redirect you to the Stripe setup.

![]()

Don’t see banner?

If you don’t see the banner at the top of your screen, you can also access the Stripe setup page by going to Payments ![]() > View Stripe payouts > click the edit pencil on the left of the screen.

> View Stripe payouts > click the edit pencil on the left of the screen.

If you need assistance with this, please reach out to MyStudio support team.

Step 3: Fill out information for "Personal details" OR "Business details"

Fill out information in "Personal details" or "Business details" depending on how your studio is set up.

Learn more about the types of businesses.

Important: Please ensure the official owner's information is listed as the representative.

Step 4: Add the statement descriptor

Stripe has added a new field for KYC verification for businesses registered as anything other than "individual." This field is the statement descriptor that will appear on your customers' purchase histories. Even if you've already connected Stripe, please follow the steps in the following article to ensure your payments aren't potentially marked as fraud:

Learn more about Stripe Statement Descriptor.

How do I know my Stripe KYC is filled out correctly?

Step 5: Verify the information is correct

You will be redirected to review the information. Fill out any missing public details including the statement descriptor (what appears on a customer’s bank statement).Once completed and you press confirm, you will see a “congrats!” screen.

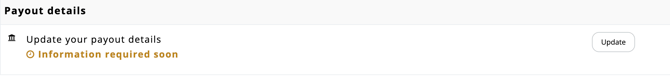

Step 6: Add payout details

After returning to your MyStudio account, you will be returning to the same "View Stripe Payouts" section. At the bottom, you will see “Payout details” and click on the button to the far right labeled “Update”. You will be redirected to V2. Under the "Payments" section, go to settings.

You will be prompted to put in bank account information for the account you would like the money received through MyStudio to go to. Once added, press “Update” button on the bottom right of the screen.

Important: We’ll send a verification code to the business owner’s email address. You’ll need this code to complete and confirm the bank account on file.

Step 7: Verify everything is set up

In your MyStudio account, it may take a few minutes to update. After a few minutes, refresh the screen and look at the “View Stripe payouts” section again. You will want to see two green check marks ![]() .

.

If you do NOT see two green check marks after refreshing your screen, look into the section you filled out but does not have the green check mark. Verify everything is filled out and correct. Make updates, if needed.

Still not able to get two green check marks? Connect with your onboarding specialist for more assistance.

Stripe setup: Frequently asked questions (FAQs)

How do I update my bank account information for payouts?

To update the bank account for payouts,

-

Log into MyStudio V2.

-

Go to Payments > Settings.

-

Find the payout details section.

-

Press "update".

-

Place in the new bank account information you want to provide.

-

After pressing "update", you will be prompted to check the MyStudio account owner's email for a verification code before updating the new bank account details.

-

Once the code added, click the verify button. Once verified you will receive a confirmation on the top right of the screen.

-

The MyStudio account owner will receive a confirmation email for this update once complete.

Important: The verification email will be sent only to the MyStudio account owner's email address. If you are not the account owner, please coordinate with them before updating the payout bank account to ensure a smooth process.

What if I already have a pre-existing Stripe account?

If you already have a Stripe account, you still need to create this new one since it is directly connected to MyStudio and there is no way to connect a pre-existing Stripe account to MyStudio. This should not be a problem, as Stripe allows you to have two accounts with the same legal entity.

Which account type should I choose during Stripe Setup?

When setting up your Stripe account, you’ll be asked to select a business type and designate a business representative. It is important to choose the correct structure and enter accurate owner information to ensure proper tax reporting, including your 1099-K form.

What type of business should I select?

Use the guide below to determine the correct business type based on how you operate and file your taxes. If you're unsure, it's best to refer to how your business files with the IRS.

|

Business type |

Who it’s for |

|

Individual |

For personal use only. No business activity or formal income. |

|

Sole Proprietor |

A single individual operating a business under their own name or DBA |

|

Single-Member LLC |

A limited liability company with one owner, taxes as a sole proprietorship. |

|

Multi-Member LLC |

An LLC with more than one owner. |

|

Private Partnership |

An unincorporated business with multiple owners, not registered as an LLC. |

|

Private Corporation |

A registered corporation filing taxes as either a C-Corp or S-Corp |

What information appears on the 1099-K tax form?

The business type you choose impacts what information appears on your 1099-K tax form. Here’s how Stripe determines whether personal or business tax details are shown:

|

Business type |

1099-K issued with |

|

Individual |

Owner’s legal name, home address and SSN |

|

Sole Proprietor |

Owner’s legal name, home address, and SSN or EIN |

|

Single-Member LLC |

Owner’s legal name, home address, and SSN or EIN |

|

Multi-Member LLC |

Business name, business address, and EIN |

|

Private Partnership |

Business name, business address, and EIN |

|

Private Corporation |

Business name, business address, and EIN |

See Stripe’s support article for more details.

What is an EIN?

The Employer Identification Number (EIN) is a number assigned to your business for tax purposes in the US. If you are a business with employees then you are required to have an EIN. If you are a sole proprietor or single LLC without employees, then you are able to enter your SSN instead.

What about statement descriptor for franchise locations?

If you are part of a franchise, you will need to include your location in the statement descriptor. For example, InCourage's Fairfax location will have "Incourage Fairfax."

How do I know Stripe KYC is correctly set up?

To ensure your KYC is correctly set up, go to payments > Stripe payouts in your MyStudio account:

- If you chose “company” during the setup process, the MyStudio view Stripe payouts section will show personal details as “not applicable” and there will be a green checkmark next to both the business details and payout details.

- If you chose “individual” during the setup process, the MyStudio view Stripe payouts section will show company details as “not applicable” and there will be a green checkmark next to both the personal details and payout details.

Once you see the appropriate checkmark, you will be prepared to start processing payments via Stripe!

Payouts

New payout speed

All new MyStudio accounts, created after January 2025, will automatically be placed into the new payout speed of T+1, where “T” represents the day the transaction took place and the number is the number of business days after the transaction. This means that you will get next business day payout speeds.

Important: Any existing accounts that would like this new payout speed can opt in to it. Please note that this will come with a small .1% increase to current processing fees. This is an increase enforced by Stripe. Once you opt in to the new payout speed, you will not be able to opt back out later.

What about payout speeds for accounts created before January 2025?

The old payout speed that Stripe offered was a rolling payout speed of (T+2) and (T+3), where “T” represents the day the transaction took place and the number is the number of business days after the transaction. This means for a (T+2) account, transactions that occurred on Monday are deposited by Wednesday, Tuesday by Thursday, etc.

Note: Transactions that occur late in the evening may not process until the next day. The payout speed occurs after the transaction processes.

Examples of old payout speed

Example 1: mid-week transactions

For US and Australia, transactions that are processed on Monday will deposit on Wednesday, Tuesday transactions on Thursday, and so on.

For Canada and the UK, transactions that are processed on Monday will deposit on Thursday, Tuesday transactions on Friday, and so on.

Example 2: weekends and holidays (T+2: US and Australia) transactions

If a transaction would deposit on a weekend (Saturday or Sunday), then these transactions will deposit on Monday, since payout speeds are based on business days. Any transactions that occur on the weekend will be processed or posted on Monday, then deposited on Tuesday.

Holidays will generally be posted the first business day after the holiday and then deposited two days (3 days for UK and Canada) after it’s posted.

Payout disclaimer

The information above is provided by Stripe to MyStudio. The above timings are a reliable representation of Stripe's commitment to transaction payout timings. However, in some circumstances, timings may vary. If you encounter delays with your payout timing, or have any questions, please contact MyStudio's customer care team by chat or phone at (757) 997-1233, and our team will be happy to assist.

Payment: Frequently asked questions (FAQs)

What are failed payments?

Failed payments occur when there is an issue with the payment method on file for a registration. This can be an immediate notice, such as during a registration, or it can become a failed payment later.

If a payment fails, it will display in your MyStudio account in payments > past due. Depending on the reason for the failure, it may have a status of either "failed" or "past due."

Why did the payment fail?

To check why a payment failed, go to payments > past due payments and export the transaction(s) you wish to check. This exported table will have a column for the payment error description, listing the reason for the failure.

Note: Transactions made before August 14, 2024 will not show a payment error description. We recommend re-running these payments first, and if it fails again the error description will appear for the rerun.

What are common payment error messages?

Check out the table below for reasons payments could fail and the actions you can take. If you have any further questions about these reasons, please reach out to our customer care team via phone 757-997-1233 or live chat at the bottom right corner of your control panel.

| Listed reason | Next steps |

| The card was declined because the transaction requires authentication such as 3D Secure. | Try re-running the payment to allow the customer to authenticate the transaction. If the card issuer returns this decline code despite a successfully authenticated transaction, the customer needs to contact their card issuer for more information. |

| The payment can't be authorized. | Attempt the payment again. If you still can’t process it, the customer needs to contact their card issuer. |

| The card was declined for an unknown reason. | The customer needs to contact their card issuer for more information. |

| The card does not support this type of purchase. | The customer needs to contact their card issuer to make sure their card can be used to make this type of purchase. |

| The customer has exceeded the balance, credit limit, or transaction amount limit available on their card. | The customer needs to contact their card issuer for more information. |

| The card does not support the specified currency. | The customer needs to check with the issuer whether the card can be used for the type of currency specified. A different payment method may need to be used. |

| A transaction with identical amount and credit card information was submitted very recently. | Check to see if a recent payment already exists. |

| The card has expired. | The customer needs to use another card. |

| The card was declined for an unknown reason or Stripe Radar blocked the payment. | The customer needs to contact their card issuer for more information. |

| The card number is incorrect. | The customer needs to try again using the correct card number. |

| The CVC number is incorrect. | The customer needs to try again using the correct CVC. |

| The PIN entered is incorrect. This decline code only applies to payments made with a card reader. | The customer needs to try again using the correct PIN. |

| The postal code is incorrect. | The customer needs to try again using the correct billing postal code. |

| The card has insufficient funds to complete the purchase. | The customer needs to use an alternative payment method. |

| The card, or account the card is connected to, is invalid. | The customer needs to contact their card issuer to check that the card is working correctly. |

| The payment amount is invalid, or exceeds the amount that’s allowed. | If the amount appears to be correct, the customer needs to check with their card issuer that they can make purchases of that amount. |

| The expiration month is invalid. | The customer needs to try again using the correct expiration date. |

| The expiration year is invalid. | The customer needs try again using the correct expiration date. |

| The card issuer couldn’t be reached, so the payment couldn’t be authorized. | Attempt the payment again. If you still can’t process it, the customer needs to contact their card issuer. |

| The payment isn’t permitted. | The customer needs to contact their card issuer for more information. |

| The card was declined because it requires a PIN. | The customer needs to try again by inserting their card and entering a PIN. |

| The customer can’t use this card to make this payment (it’s possible it was reported lost or stolen). | They need to contact their card issuer for more information. |

| The allowable number of PIN tries was exceeded. | The customer must use another card or method of payment. |

| An error occurred while processing the card. | The payment needs to be attempted again. If it still can’t be processed, try again later. |

| The payment couldn’t be processed by the issuer for an unknown reason. | The payment needs to be attempted again. If it still can’t be processed, the customer needs to contact their card issuer. |

| A Stripe test card number was used. | A genuine card must be used to make a payment. |

| The customer has exceeded the balance or credit limit available on their card. | The customer needs to use an alternative payment method. |

The following additional reason descriptions need to be handled more carefully:

| Listed reason | Next steps |

| The payment was declined because Stripe suspects that it’s fraudulent. | Don’t report more detailed information to your customer. Instead, present it as "the customer needs to contact their card issuer for more information." |

| The payment was declined because the card is reported lost. | |

| The payment was declined because it matches a value on the Stripe user’s block list. | |

| The payment was declined because the card is reported stolen. |

Note: If your exported payment history lists a transaction as past due and does not contain a payment method or payment error description, this means the customer pays manually with cash or check, and payment needs to be taken in person.

General solutions

1. Rerun

Any failed payment attached to a credit card or ACH can be rerun either from the payments > payment history section, or from within a registration page’s payment history. We recommend doing this first.

Payment History: go to payments > payment history > check the box next to the payment > click "rerun payment."

Registration Page: go to all customers > participants > the category the past due payment is in (in the screenshot below I went to program participants) > click the participant name > payments > click "re-run failed payments."

Clicking this re-run failed payments option will re-run ALL listed failed payments. If you want to only re-run individual ones, drop down the list > click the past due payment you would like to re-run > re-run payment.

2: Customer notification

If re-running the payment method still results in a failed payment, export the failed payment and check the reasoning column. There may be an issue with the customer's card that they need to address with their bank. Even in cases where the reason listed is unknown, it is still good to inform the customer.

When a payment goes into a past due status, the customer will receive an email. If there was a credit card or ACH attached to the payment, the email will prompt them to update their payment method on file. If the customer updates the payment method, their past due payment will rerun automatically. If a manual payment method such as cash or check was attached to the payment, the email will not contain an “Update” option.

Customers will receive this past due payment email every 3 days until credit is applied to the past due payment or the customer updates the payment method. Additionally, customers will not be able to access the member app if they have past due payments on file connected with a credit card or ACH. Customers will be prompted to update the payment method on file for these payments or rerun the payments as soon as they login and attempt to go to a category within the app.

3. Update payment method

If rerunning the payment doesn't work and the customer doesn't automatically update the payment info from the email, you will need to ask the customer to update their payment information for the registration. To do this, go to all customers > participants > the category the past due payment is in > click the participant name. In the example below we are in a program registration internal page.

Under payment method, click "send link for user to update payment method." This will send them an email prompting them to update their payment information. Once they do, ALL failed payments under that registration will be re-run at once.